Performance Competitions

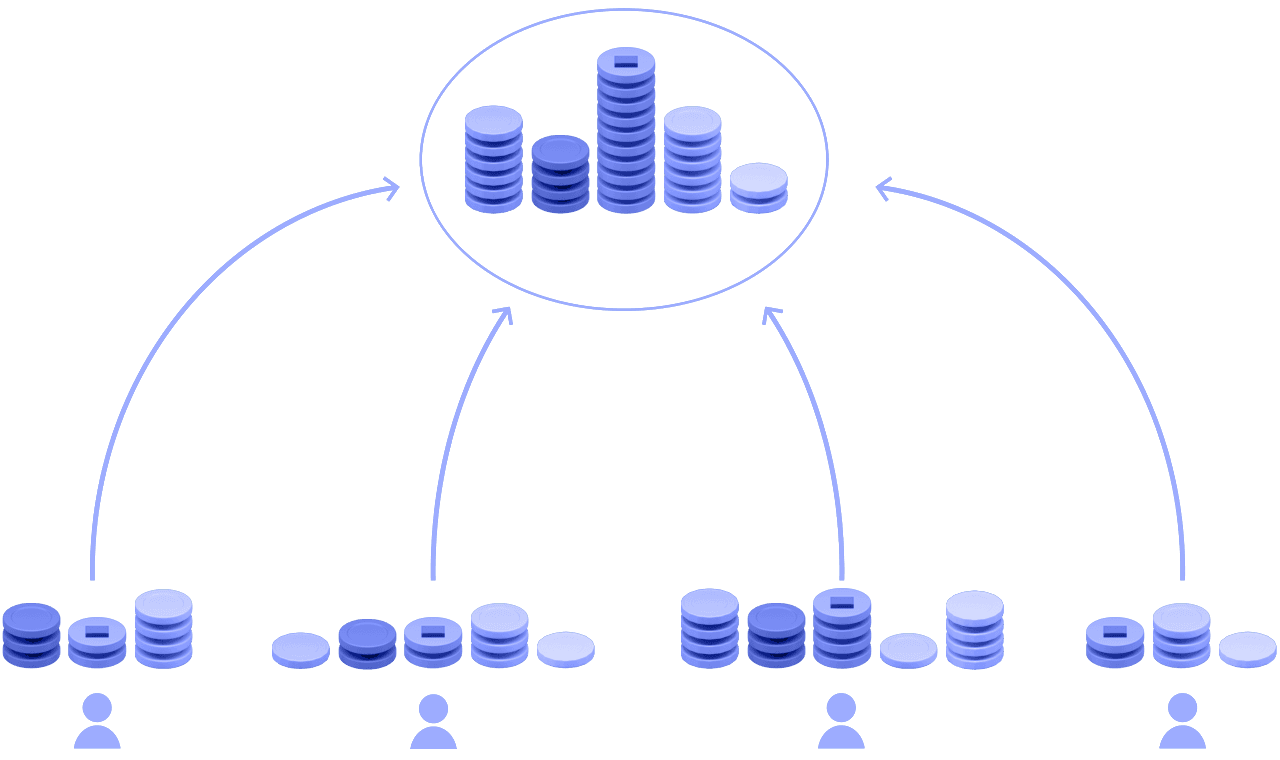

You can participate in regular competitions to shape Multi's asset backing. During each submission window, participants propose changes and commit stakes. Once closed, the system implements these changes proportionally to stake size. Throughout the evaluation period, performance is tracked as stakes gradually unlock. If your strategy performs well, you'll receive your stake back plus rewards from underperforming participants and the system. If your strategy underperforms, your unlocked stake transfers to successful participants or the system.

- Propose changes & commit stake during each submission window.

- Changes are implemented based on stake proportion after the window closes.

- Your stake size directly influences your proposal's impact.

- Performance over time determines if your stake returns with gains or is redistributed.